When buying a home, it’s important to start out by knowing what mortgage you can comfortably afford. You should meet with a lender or mortgage broker to establish how much of a mortgage you can actually qualify for. Going through the mortgage pre-qualification process before you begin your home search will bring your house hunting into focus and give you a better idea of the homes that fit into your price range.

When buying a home, it’s important to start out by knowing what mortgage you can comfortably afford. You should meet with a lender or mortgage broker to establish how much of a mortgage you can actually qualify for. Going through the mortgage pre-qualification process before you begin your home search will bring your house hunting into focus and give you a better idea of the homes that fit into your price range.

Not only that, mortgage rates vary considerably and it is obviously to your short- and long-term advantage that you shop around for the best rate, terms and options.

You don’t want to sacrifice lifestyle for a house. Determine how much of a home (mortgage) you can afford by considering the following and doing your homework. You won’t regret it!

- Your annual household income.

- Your down-payment (you should have 5% of the purchase price of the home for the down payment, but ideally even more).

- Your debt-load.

- Your interest rate.

- Your monthly mortgage payment.

- Your amortization period (length of time required to pay off the loan).

- Your closing costs.

- Your property taxes.

- Your homeowner’s insurance.

- Your home maintenance costs.

A good place to begin is with the affordability calculator (in the right hand sidebar). It will help you determine the maximum mortgage you can afford and will give you an idea of what monthly mortgage payment to expect.

Click Buying – Step 3: Calculate Your Costs for more detailed information. If you’d like to discuss mortgage affordability call Bill Brandsma at 403-932-4433 to arrange an appointment.

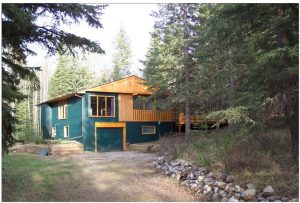

Well cared for 1147 sq ft home located on a quiet street in the desired community of Glenbrook. Cozy living room with wood burning fireplace, formal dining room, functional kitchen, fully developed lower level offers 3 bedrooms, large family room with wood burning stove and much, much more. Fully fenced and landscaped yard with private patio area and oversized double garage and RV parking.

Well cared for 1147 sq ft home located on a quiet street in the desired community of Glenbrook. Cozy living room with wood burning fireplace, formal dining room, functional kitchen, fully developed lower level offers 3 bedrooms, large family room with wood burning stove and much, much more. Fully fenced and landscaped yard with private patio area and oversized double garage and RV parking.

If you like to stay up to date on what’s going on in the Calgary real estate market so that you can make informed decisions, click the link below for an excellent overview of CREB’s latest summary of Calgary’s residential monthly statistics:

If you like to stay up to date on what’s going on in the Calgary real estate market so that you can make informed decisions, click the link below for an excellent overview of CREB’s latest summary of Calgary’s residential monthly statistics: Yep, we’re well into the lazy, hazy days of summer!

Yep, we’re well into the lazy, hazy days of summer! When buying a home, it’s important to start out by knowing what mortgage you can comfortably afford. You should meet with a lender or mortgage broker to establish how much of a mortgage you can actually qualify for. Going through the mortgage pre-qualification process before you begin your home search will bring your house hunting into focus and give you a better idea of the homes that fit into your price range.

When buying a home, it’s important to start out by knowing what mortgage you can comfortably afford. You should meet with a lender or mortgage broker to establish how much of a mortgage you can actually qualify for. Going through the mortgage pre-qualification process before you begin your home search will bring your house hunting into focus and give you a better idea of the homes that fit into your price range. Immaculate, modern fully developed semi-detached home located in a quiet location in the district of Fireside – ready for you to move in!

Immaculate, modern fully developed semi-detached home located in a quiet location in the district of Fireside – ready for you to move in!

Key features:

Key features: